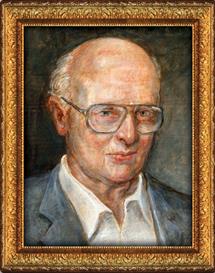

Harry Markowitz

Harry MarkowitzIn this volume, Mark Hebner meticulously refutes the idea that investors can beat the market by stock selection or market timing. Some readers may react with the thought that “perhaps most investors cannot beat the market, but some can. I merely have to emulate those with superior performance.” Examples of investors with sustained superior performance include the legendary Warren Buffett and David Swensen, Yale University’s chief investment officer, whose performance over decades has been widely admired and imitated by endowment and retirement plan managers, but with rare success.

If you examine the words and practices of these distinguished investors, you will find their above-market performance is not due to a set of rules which can be followed by individual investors. Rather, it is due to resources and opportunities which individual investors and most institutional investors do not have. Swensen tells how he does it in his book, “Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment.” As noted in the title, Swensen’s book explains how an institutional investor (as distinguished from an individual investor) might achieve above-market returns. He observes there is little chance for beating the market with well-followed securities such as large-cap and small-cap stocks. As to opportunities available to the institutional investor from less conventional sources, Swensen writes: “Populated by unusually gifted, extremely driven individuals, the institutional funds management industry provides a nearly limitless supply of products, a few of which actually serve fiduciary aims. Identifying the handful of gems in the tons of quarry rock provides intellectually stimulating employment for the managers of endowment portfolios.” 1

Few, if any, individual investors have the time and skill to separate the “gems” from the “quarry rock,” even if they were presented with similar opportunities. Any individual investor who believes he or she can achieve above-market performance is almost sure to underperform the market substantially.

Hardly any institutional investors are able to outperform their proper benchmarks. Among those who do accomplish this feat, their ranks largely change from year to year, making their discovery a moving target, as Mark Hebner shows in this volume. Swensen affirms the difficulty of identifying skilled fund managers. He states, “I erred in describing my target audiences. In fact, I have come to believe that the most important distinction does not separate individuals and institutions… few institutions and even fewer individuals exhibit the ability and commit the resources to produce risk-adjusted excess returns.”2

Indeed, the challenge of ferreting out the gems from among the “tons of quarry rock” is more challenging than it might first appear.

While Warren Buffett has not written a text on the subject, his actions show his success — like Swensen’s — is in part due to his being offered opportunities not available to the individual investor. Specifically, he is offered the opportunity to take large positions in established companies at favorable prices. At such times, company information is made available to Mr. Buffett and his staff which is not routinely available to the public. Ultimately, however, it is his and his staff’s ability to evaluate such positions — to separate the gems from the quarry rock — that explains their long-run success. As in the case of Swensen’s outperformance, few individual investors have the time and skill to evaluate such opportunities, even if they were presented to them.

As to market timing, I know of no one who has consistently outperformed the market by market timing. Since there are always countless “authorities” who say to buy, and countless others who say to sell, there will always be many instances in which someone called correctly the last turn of the market, and even the last two or three turns. As Mr. Hebner documents, it is a foolish hope to try to emulate such market timers. It is better to go with J.P. Morgan’s advice — that all one knows about the market is that it will fluctuate.

J.P. Morgan’s observation has at least three implications. The obvious one is: Don’t try to time the market. You will make your broker rich, not yourself. Another implication is you should choose a portfolio you can live with despite market fluctuations. For example, the year 2008 was not an “outlier,” nor was it even the worst year on record. Rather, it was tied for the second-worst year. It was a one-in-forty year event, not a one-in-a-thousand year event. The frightened investor who decided to get out of the market in March 2009 locked in his or her losses for good. The chief problem with investors is they buy after the market has gone up and believe it will rise further, and they sell after the market has fallen and believe it will fall more. One of the principal functions of the right financial advisor is to make sure the investor understands the volatility of his or her specific portfolio and is willing to stick with it for the long-run.

As Mr. Hebner explains, a third implication of the fact that markets fluctuate is the need to rebalance. Suppose an investor is comfortable with a 60-40 mix of stocks versus bonds. If the market has risen substantially, the portfolio’s equity exposure will greatly exceed sixty percent. The rebalancing process sells off the excess, bringing the portfolio back to a 60-40 mix. If the market has fallen, then the portfolio will have less invested in stocks than the target 60 percent. The rebalancing process then buys. This process of rebalancing — which sells after the market has gone up and buys after the market has gone down — is sometimes referred to as “volatility capture” and leads to what Fernholz and Shay (1979) refer to as “excess growth.”3 The rebalanced portfolio will grow faster than the average growth of its individual constituents. It may even grow faster than any one of its constituents due to the rebalancing process. Thus, if handled knowledgeably, market volatility can be the investor’s friend.

“Money in the bank” sounds safe, but will do little to outpace inflation. On the average, over the long run, a well-diversified portfolio that includes stocks and bonds will almost surely continue to outpace both inflation and money in the bank. However, as this book documents so well, a foolish attempt to beat the market and get rich quickly will make one’s broker rich and oneself much less so.

– Harry Markowitz, Ph.D.

1990 Nobel Prize Recipient

Harry Markowitz, Ph.D. is best known for his pioneering work in Modern Portfolio Theory, for which he was awarded the 1990 Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (referred to as the Nobel Prize in this book). In 1952, he developed the simple, yet profound notion that investors must consider the risk associated with their investments, not solely the return. This groundbreaking discovery sparked a financial revolution pertaining to the relationship between risk and return. He is widely known as the “Father of Modern Portfolio Theory”. Dr. Markowitz is also the recipient of the 1989 John von Neumann Prize in Operations Research Theory for his work in the areas of sparse matrix techniques and the SIMSCRIPT programming language, in addition to portfolio theory. He currently serves as an Adjunct Professor of Finance at the Rady School of Management at the University of California, San Diego.

Mark Hebner

Mark HebnerMark T. Hebner is the founder and president of Index Fund Advisors Inc., (IFA.com), author of the highly regarded book Index Funds: The 12-Step Recovery Program for Active Investors, is the creator of and is featured in the award winning documentary film of the same name, and architect of ifa.com, one of the most comprehensive websites focused on investor education. This book and previous editions received praise from financial industry experts and academic luminaries, including John Bogle, David Booth, Burton Malkiel, and Nobel Laureates Harry Markowitz and Paul Samuelson.

Hebner is a respected speaker, frequent news contributor and authority on investing. His life’s mission is to “change the way the world invests by replacing speculation with education.” Hebner is especially knowledgeable about index funds, portfolio construction and the research indexes designed by Nobel Laureate Eugene Fama and Kenneth French. These indexes provide the building blocks for the prudent evidence-based investment strategies that Hebner implements for his IFA clients.

Americans work hard. On average we log 7.6 hours each working day,4 with many of us amassing far more hours to meet our current needs and secure our retirement. We are dedicated to our work and to saving for our “golden years.”

Rarely in the course of this frenetic pace do we stop to learn how to properly invest our savings so they can best work for us.

I was one of those people. I was fortunate enough to start a successful company right after I graduated from college. I was 32-years-old when I sold it and walked away with a very nice sum of money. Without a second thought, I deposited those proceeds with a big-name brokerage firm. They seemed to be looking out for my best interests and competent enough to grow my wealth through their stock-picking prowess. They had offices in high-rise towers. They had well-dressed analysts and impressive looking reports. I was confident they would effectively put my money to work for me.

Twelve years later, I woke up to the ugly truth that my confidence in that brokerage firm was unfounded, and my time spent trying to beat the market had been wasted.

Until that time, I believed the financial success of Wall Street brokerage firms was the result of creating wealth for their clients. I learned too late that brokerage firms did not get rich by enhancing their clients’ wealth, but rather (and ironically) by depleting it, transferring it slowly to their pockets in the form of commissions and margin interest that were in no way justified by the below-benchmark returns. This steady transfer of funds from clients to brokers buys plenty of full-page ads in the Wall Street Journal and ample commercial time on CNBC to lure in even more clients, thus perpetuating the slow transfer of wealth that comes with each buy and sell.

Prior to my revelation, I lived with a nagging suspicion that my investments could do better. I suspected there was a better way to invest, but I never really had the motivation to find it. I was busy with my family and my work, and I could never put a finger on the risks I had taken or the returns I should have earned for those risks.

My revelation about the investment world came to me through a tragedy. A friend of mine was killed in a car accident. I told his widow I would help her in any way I could. A few years later, she said what she really needed was help with her investments. I knew she was relying on me to provide some good, solid help, and I also knew I was ill-equipped to give it.

“What do I know about investing?” I asked her. “My own portfolio hasn’t done that well.” I knew I had to do some research. I knew I needed to find a better way to invest, and I needed to share it with her. I revisited the finance courses from my MBA program at the University of California, Irvine. I went to the library and the bookstore and bought more than 20 books on investing, and I read them all. (My library now includes 2,565 books on finance, economics and investing dating back to 1648.) I dug into Burton Malkiel’s Random Walk Down Wall Street and John Bogle’s Common Sense on Mutual Funds, among many others. What I discovered in the pages of those books was nothing short of stunning, but can easily be summarized as this: managers don’t beat markets.

At first I asked, “How could this be? We have all these managers in the world who are in business to beat the market, and yet, they’re not beating the market. The market is beating them.”

It struck me like a bolt of lightning: I didn’t just have the wrong brokers and managers, I had the wrong investment strategy altogether. With all of the time, effort and money spent trying to find the next hot stock or mutual fund manager, I would have been far better off had I simply bought, held and rebalanced a portfolio of index funds. How much better off? When I compared my own actively managed portfolio’s performance against the value of a risk-appropriate passively managed portfolio, I was struck with the harsh reality of the price I paid for my lack of investing knowledge. I call this my $30 million investment lesson.

I paid a very steep price for relying on an industry that profits handsomely when investors are kept in the dark. I wondered just how many others had paid a high price for too little knowledge and too much trust. I questioned how many more would suffer before the investment industry would awaken to its very own Howard Beale—who would finally muster the courage to step before the CNBC cameras to declare, “I’m mad as hell, and I’m not going to take it anymore.”

Awestruck by the glut of misinformation that served as the basis for poor investment decisions, I could not remain silent. I knew I had found my mission in life, and I was determined to change the way the world invests. The World Wide Web provided the perfect medium for my mission.

Just as in the movie “Network,” in which Beale used the airwaves to deliver his message, I leveraged the Internet to deliver mine. In 1999, I launched what was the world’s first robo-advisor, which is now ifa.com, a free and comprehensive site that contains thousands of dynamic charts, graphs, articles, podcasts, books, videos and a documentary film based on this book. I did all of this to help investors learn about the value of a passive advisor with a fiduciary duty to its clients, one who advises on investments that can better capture the returns offered by markets around the world. At the same time, I launched Index Fund Advisors Inc., a fee-only fiduciary wealth services firm that works with individuals, retirement plans and institutions to invest in risk-appropriate portfolios properly matched to each investor’s risk capacity. With 41 employees, 2,400 clients and $3.86 billion in assets under management (March 2018), IFA’s mission has begun to become a reality.

This book incorporates the quality research and data that IFA uses to advance the financial futures of its clients. It is the same information I utilize daily to educate investors. Step by step, this book will lead you away from the pitfalls of active investing that threaten your long-term financial success and instead lead you toward a strategy that will efficiently put your money to work with the goal of providing you an all-around better investing experience.

You work hard enough. You don’t need to log any more hours or pay any more commissions to fund your broker’s retirement instead of your own. Read the following pages carefully, as they hold the key to your ability to optimally reap the returns for the risks you take.

Yes, you can finally invest and relax.

– Mark T. Hebner